Home Ownership

Eligibility

Evergreen Habitat for Humanity provides the opportunity for families and individuals to purchase affordable homes throughout Clark County. Our model allows Habitat homeowners to build equity in their homes, while ensuring that the home is affordable to the next buyer.

Families are selected based on meeting three criteria:

Need

Applicants must demonstrate that their current housing does not meet their family’s needs. If your current residence is inadequate because of overcrowding, structural damage or does not meet current property codes, or has maintenance issues that your landlord does not tend to, you may qualify for a Habitat home.

The following is a list of other reasons that may qualify as a need for housing:

- Unsafe neighborhood

- Rent is not affordable (more than 50% of monthly income)

- Housing is transitional

- Housing is subsidized

Ability to Pay

Applicants purchase Habitat homes with moderate interest rate mortgages based on participating lenders special programs. Evergreen Habitat considers credit history, employment, and debt-to-income ratio to determine an applicant's ability to make regular payments and to cover closing costs.

Qualifying Issues to consider:

- Collections Limit: $0, small lower amounts may be an exception, lender determined

- Credit score: Minimum 620

- No liens or judgments

- First time homeowner (have not owned a home in the last 3 years - manufactured homes excluded).

- Bankruptcy: Chapter 7 – 4 years discharged. Chapter 13 – 2 years discharged.

- Employment: For wage earners, you must have two years of steady employment with the same employer. Exceptions may be made for changed jobs in the same field.

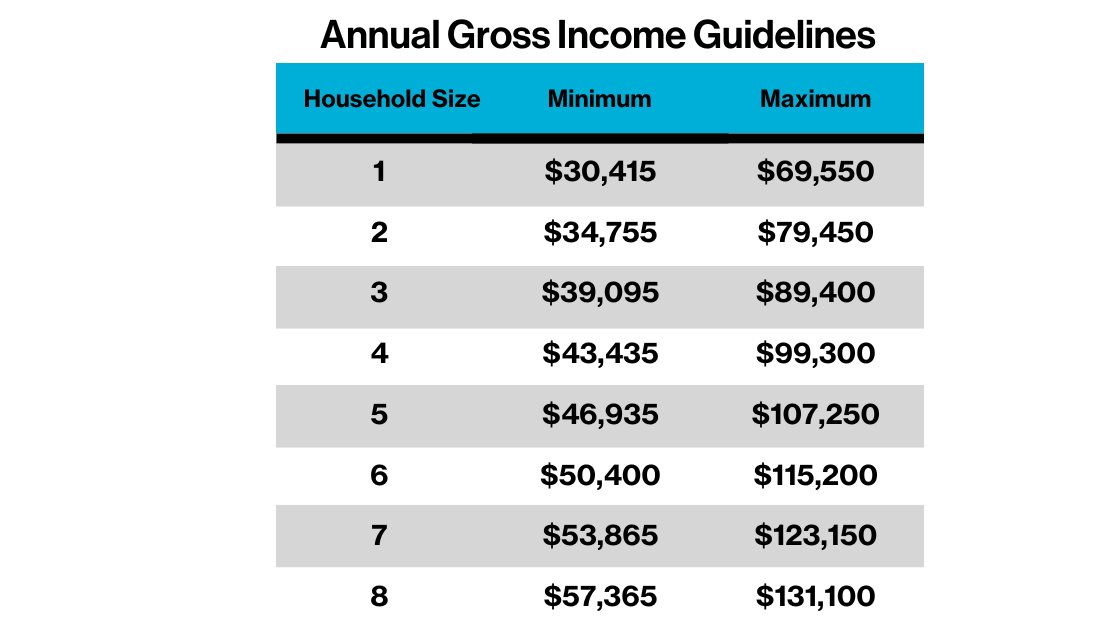

- See income qualifications below.

Willingness to Partner

Homebuyers participate in the construction of their home by completing participation hours - building their home and their neighbor's home. Hours can also be completed by attending required classes, volunteering at our Habitat Store, or by volunteering in your community.

How to Apply

The first step in the application process is to attend a required orientation. Please contact Michelle Gutierrez at (360)737-1759 x2 or MichelleG@ehfh.org for any questions. The Homeowner Services Department is open Monday to Friday from 8am to 4pm. Please call to schedule an intake appointment to turn in completed applications.

IN-PERSON ORIENTATIONS ARE OPEN.

Homeownership FAQ

Looking to become a Habitat for Humanity homeowner? Below are some common questions our applicants have. If you do not find answers to your questions below, please contact our homeownership department at MichelleG@ehfh.org.

How does the program work?

Evergreen Habitat homeowner’s mortgage payments are kept affordable and set based on their income at the time of sale. This monthly amount will include the primary mortgage payment, homeowners insurance, land lease fee, interest, and property taxes. Habitat for Humanity provides additional subsidies and/or a second mortgages to cover the difference between what the buyer can afford in a first mortgage and the sales price of the home.

How are homes kept permanently affordable?

Our permanent affordability model uses a resale formula that provides sellers with 1.5% compound interest over the life of the mortgage, plus what they have paid towards their mortgage. This ensures that the homeowner can still build equity, this coupled with a land lease as Habitat retains the deed to the land keeps the home permanently affordable to the next buyer. This guarantees affordable neighborhoods into the future, for Clark County.

What is the first step toward purchasing a home?

If you are interested in the Habitat for Humanity program and have reviewed the requirements to see if you qualify, the next step is to attend an orientation, offered twice a month. This orientation is required so you can determine if our Home Trust, permanently affordable model is right for you.

How do applicants qualify?

Applications are accepted year round. The first step is to attend the required orientation, then submit a pre-application, either online through a secured portal or on paper with an application fee of $55. Applications will be processed in order of receipt and continue through until all available homes have a qualified buyer. Along with the pre-application, applicants will be asked to submit additional information such as pay stubs, bank statements, and tax returns. Habitat staff will use that information, as well as information from the pre-application and a credit report to determine eligibility for our program. This is not the final step, final step includes qualifying with a third party lender.

What type of homes does Habitat build or remodel?

We typically build two- to five-bedroom wood frame homes with approximately 900 to 1500 square feet. We also rehab homes in which the square footage and amenities of homes vary. An electric or gas range, refrigerator, and dishwasher are provided with most homes. Habitat homes or remodel homes can be single units or attached and share walls.

Do applicants get to choose the location or design of the home?

The location of the home is dependent upon where Habitat is building or remodeling houses. The locations available will usually be discussed during the homeownership application process. Habitat does not build custom homes. Habitat will choose the size of the home based on household size and makeup. We expect two children of the same gender to share a bedroom if they are close in age.

Who can be a part of my household? How is my household size determined?

Only individuals who are currently living in the household can be considered when determining household size and the number of bedrooms the applicant qualifies for. A child is only considered in regard to household size if the applicant has at least 50% custody of that child. We do occasionally make exceptions and definitely want to make sure that household members are not discounted when appropriate. If a person is pregnant during the application process, the unborn child will be counted towards the household size. Please be sure to explain any household size situations in your application.

If pre-approved, how long will it take before I purchase a home?

Homebuyers are in the program until their home has been built or remodeled; generally, this could take 6 to 24 months. Ideally, construction of a pre-approved homebuyer’s home begins within six months from the time of approval. Completion dates of the homes vary, are subject to change and never guaranteed. The construction process is complex with many variables including funding sources, the construction schedule and building requirements. This complexity makes it difficult to predict the length of time from pre-approval in the program to purchasing a home.

What are the program requirements once I qualify?

Homebuyers will complete participation hours. Participation hours refer to the actual hands-on involvement of Habitat homebuyers in the construction or rehab of their own homes. Hours can also be done in our Habitat retail Store, as well as participation in other Habitat and community activities, and a series of education classes. All hours must be completed before pre-approved homebuyers purchase their home. Hours will vary per project, for example, hours for a newly construction home may be different for a rehab home. Education topics include: Financial Readiness, First Time Home Buyer class, Maintenance and Warranty/Good Neighbor, and a Ground Lease class. All classes will be provided by Habitat free of charge.

What if I don’t qualify?

Not all applicants are mortgage ready the first time they apply. We have community partners that will work with you if your credit does not meet our standards or the standards of our third-party lending partners. Once you feel your credit has been improved you are welcome to apply again.

What if during the process I change my mind?

Some applicants start our program and then realize it is not for them, or life circumstances change and they need to withdraw. This is perfectly fine, you just simply notify us in writing that you wish to withdraw from the program.

Can I will my home to my children?

Yes! Even though this is a difficult topic for people to prepare for, drawing up the appropriate paperwork is always best to have. Your home will be the biggest asset you will own and knowing you can leave it to your loved ones gives you peace of mind.

Can I sell my home?

Yes! There are resale restrictions, this will be covered in the onboarding and the ground lease class. You can sell your home any time you like to.

HOME REPAIR

Habitat for Humanity’s Home Repair program is an extension of our core building program and follows the same basic criteria for selection: need, ability to pay, and willingness to partner. In order to have a greater impact on Clark County neighborhoods, Evergreen Habitat for Humanity launched the repair program in 2011, completing minor exterior repair. In 2019, Habitat re-launched the program and now completes work on the interior as well as exterior. Home Repair services help preserve affordable housing in Clark County and often helps homeowners continue to live independently and securely in their homes.

Sample repair services include:

- Exterior work:

- Painting, scraping, caulking

- Minor siding, trim, or fascia repair

- Roof Replacement

- Wheelchair ramps

- Accessibility improvements (board replacement, stairs,

- handrails, grab bars, etc.)

- Heavy brush and junk removal (code enforcement)

- Interior repair as deemed within our scope of work:

- Electrical

- Plumbing

- Accessibility improvements (grab bars, transition strips, etc.)

To apply for assistance through the Home Repair program, you must have an income between 20-60% of the local median income, own your home, and have homeowner’s insurance. See the income chart here. If you own a mobile home, we currently are not taking new applications until further notice.

If you are interested in applying for assistance through the Home Repair program or learning more about how Habitat can help, please fill out the interest form below and someone will be in contact shortly.

Highlighted Homeowners

Other Resources

Rental Communities and Rental Assistance

The Council for the Homeless is a nonprofit dedicated to serving individuals in Clark County by helping everyone to have the opportunity for safe and affordable housing. The mission is to lead the community’s efforts to prevent and end homelessness to those in need. If you need immediate housing, call the Housing Solutions Hotline at (360) 695-9677.

REACH Community Development is a nonprofit organization serving Southwest Washington and Portland. They have affordable housing rental communities throughout Clark County stretching from western Vancouver to eastern Washougal. Phone: (360) 326-4647

Vancouver Housing Authority provides affordable rental housing and housing assistance for more than 12,000 residents of Clark County, Washington. Address: 2500 Main Street, Vancouver, WA 98660. Phone: (360) 694-2501

Specialty Housing Needs

Clark County Affordable Homeownership Program Vancouver Housing Authority and the VHA nonprofit Vancouver Affordable Housing partnered with Evergreen Habitat for Humanity and Proud Ground to create the Clark County Affordable Homeownership Program (CCAHP). This partnership formed to address the difficulties faced by first-time homebuyers entering the housing market — namely, the high median value of homes and the lack of affordably priced inventory available for households earning less than 80% of the area’s median income.

Home Repair

Other Local Habitat Affiliates

Habitat for Humanity Portland Region Serves Multnomah County and parts of Washington and Clackamas Counties.

Search for Other Local Habitat for Humanity Affiliates